Alex Szarka's Latest Posts

WATCH: Navigating Inflation, Interest Rates & Stock Trends

Join us for this insightful episode of Money Talks where Les and Alex Szarka delve into the complexities of today’s financial landscape. They discuss the critical economic indicators affecting both investors and the general populace, examining everything from the surge in inflation rates to the unpredictable movements of the stock markets in light of current economic trends. Equip yourself with expert knowledge on how to navigate these changes with strategy and insight.

🔹 Key Topics Covered:

Inflation Insights: Delve into recent inflation trends and what future forecasts might hold.

Interest Rates: Decode the Federal Reserve’s policies and their implications for the economy.

Stock Market Analysis: Unpack the causes of recent market fluctuations and key factors for investors to monitor.

Economic Indicators: Analyze vital statistics like employment figures and consumer sentiment to gauge economic health.

🔹 Why You Can’t Miss This Episode:

Expert Guidance: Benefit from the deep expertise of seasoned financial planners, Les and Alex Szarka.

Practical Tips: Discover how recent economic developments could impact your financial planning and investment decisions.

Market Predictions: Receive informed predictions about potential market movements in the upcoming months.

READ: New Client FAQs

Understanding the Basics: How We Handle Your Financial Services at Szarka Financial

Welcome to the Szarka Financial family! As a new client, you’re likely curious about how we manage your accounts and the behind-the-scenes process. We’ve compiled this blog post to address some of your common questions and serve as a helpful guide you can refer to at any time.

Account Transfers: Patience Pays Off

Transferring accounts to a new financial institution can be slow, often taking several weeks or more, even when everything goes smoothly. Rest assured, we closely monitor every step of the process and will keep you informed. We’ll reach out promptly if you require any additional information or documents. Meanwhile, you are always welcome to contact us for an update on your transfer status.

Account Statements: Keep Them Safe

We provide account statements in electronic and printed formats. Retaining all your statements is essential for tax purposes. When we meet, please bring these statements along with any from other investments you might hold, which will help us discuss your overall financial picture and answer any specific questions you may have.

Transaction Confirmations: Record Keeping Is Key

Each transaction or trade made on your behalf is accompanied by a confirmation, which you should keep for your records. These confirmations are important for tracking activity and necessary for tax purposes.

IRA Contributions and Distributions: Timely Actions

You can make IRA contributions for the previous calendar year until April 15. Once you turn 73, the IRS requires you to take minimum distributions (RMDs) from your IRAs. Our team is here to help you manage these contributions and distributions efficiently.

Withdrawal Options: Flexibility for Your Needs

Szarka Financial offers various withdrawal options. Whether you prefer lump sum or systematic withdrawals set up to occur automatically from certain accounts, we can accommodate your needs. Withdrawals can be sent directly to your bank account or mailed as a check. Let us know if you want to explore these options more.

Significant Life Changes: Keeping Us Informed

Life is full of unexpected events—some joyous and others challenging. Major life events such as a divorce, losing a loved one, or a job loss should be reported to us as soon as possible as these could significantly impact your financial status. Keeping us informed allows us to make necessary adjustments and provide the support you need during these times.

Our Client Manager Team: A Personal Touch

At Szarka Financial, we understand that sometimes you need to talk to someone. Our client manager team is here to provide that personal touch. A phone call can often be the quickest way to get the help you need or resolve any issues. We encourage you to reach out directly to your client manager whenever you feel it’s necessary. They are well-equipped to handle your queries with the attention and care you deserve.

While this list isn’t exhaustive, it covers the fundamental aspects of what we handle together at Szarka Financial. We’re committed to supporting you through every step of your financial journey. Should you have any further questions or need assistance, please do not hesitate to contact our team.

WATCH: Financial Empowerment with Szarka Financial

READ: Making a Charitable Gift

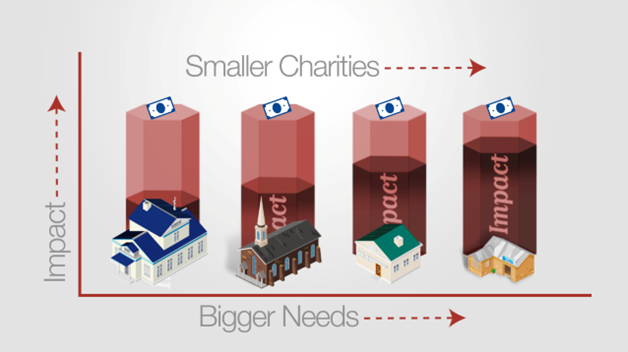

Why sell shares when you can gift them? If you have appreciated stocks in your portfolio, you might want to consider donating those shares to charity rather than selling them.

Donating appreciated securities to a tax-qualified charity may allow you to manage your taxes and benefit the charity. If you have held the stock for more than a year, you may be able to deduct from your taxes the fair market value of the stock in the year that you donate. If the charity is tax-exempt, it may not face capital gains tax on the stock if it sells it in the future.1

Keep in mind this article is for informational purposes only. It’s not a replacement for real-life advice. Make sure to consult your tax and legal professionals before modifying your gift-giving strategy.

“The greatest donor satisfaction may come with a combination of time and money.”

There are several reasons to consider donating highly appreciated stock to a tax-exempt charity. For example, you may own company stock and have the opportunity to donate some shares. There also are potential tax benefits to consider if you donate appreciated securities that you have owned for at least one year.

If you sell shares of appreciated stock from a taxable account and subsequently donate the proceeds from the sale to charity, you may face capital gains tax on any gain you realize, which effectively trims the benefit of cash donation.1

When is donating cash a choice to consider? If you provide the charity with a cash gift, there may be some limitations. Cash gifts are generally deductible up to 50% of adjusted gross income. As an example, if a donor in the top 37% federal tax bracket gives a 501(c)(3) non-profit organization a gift of $5,000, the net may be $3,150 with $1,850 realized in tax savings. A donor should also need to consider state taxes in addition to federal.2

If you donate shares of depreciated stock from a taxable account to a charity, you can only deduct their current value, not the value they had when you originally bought them.1

Remember the tax rules for charitable donations. If you donate appreciated stock to a charity, you may want to review IRS Publication 526, Charitable Contributions. Double-check to see that the charity has non-profit status under federal tax law, and be sure to record the deduction on a Schedule A that you attach to your 1040.1

If your contribution totals $250 or more, the donation must be recorded – that is, the charity needs to give you a written statement describing the donation and its value and whether it is providing you with goods or services in exchange for it.2

If your total deduction for all non-cash contributions in a tax year exceeds $500, then complete and attach Form 8283 (Noncash Charitable Contributions) to your 1040 when filing. If you donate more than $5,000 of property to a charity, you will need to provide a letter from a qualified appraiser to the charity (and by extension, the IRS) stating the monetary value of the gift(s).2

Gifting cash or other assets to an organization is a wonderful opportunity. But keep in mind that tax rules are constantly being adjusted, and there’s a possibility that the current rules may change. Make certain to consult your tax and legal professionals before starting a new gifting strategy.

- IRS.gov, 2023

- IRS.gov, 2023

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG, LLC, is not affiliated with the named broker-dealer, state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security. Copyright FMG Suite.